The financial services industry has long been a leader in figuring out new and faster ways to transact and improve the customer experience.

The emergence of disruptive Financial Technology companies and their innovative use of technology has sparked a shift in the industry. Now, both FinTech startups and traditional financial enterprises, including large retail and investment banks, are converging to optimize customer experiences through the adoption of cloud-native technology.

A recent S&P Global Market Intelligence FinTech funding report says FinTechs have undoubtedly made a mark across use cases — payments, insurance technology, digital lending, banking technology, investment and capital markets technology, and financial media and data solutions— by acting as customer-facing intermediaries or collaborating with financial institutions and enterprises.

Yet as the global economy becomes uncertain, financial services organizations of all types and sizes must bolster operations to withstand market volatility, inflation, declining consumer confidence, and increased credit risks. They need to adapt their strategies and operating models to maintain advantage. That has financial firm leaders, particularly fast-moving FinTechs, leaning into preservation strategies to ensure their resilience and competitive edge in the market.

Why FinTechs are at a higher risk

The relentless pace of technological advancements and increasing competition in the FinTech sector have pushed companies to innovate faster, leveraging technologies and initiatives such as AI/ML, predictive analytics, and app modernization. Yet, these innovations often come with complex systems that need to be closely monitored to ensure they work as intended. Mobile Banking requires a seamless user interface, real-time transaction processing, and high security. Digital Payments must manage fast transaction speeds, scalability during peak times, and secure data handling. Automated Investing/Advising needs advanced algorithmic models, real-time market data, and personalized customer interfaces. Regulatory scrutiny is also higher for FinTechs due to the sensitive nature of financial transactions, which necessitates high levels of transparency and compliance.

FinTechs also bear a higher cost of downtime. Customer trust can be significantly impacted by system failures or performance issues, leading to potential revenue loss and damage to the brand’s reputation. As such, maintaining high availability is paramount.

In this high-risk, high-reward environment, FinTechs require exceptional observability to ensure system performance, detect anomalies, prevent fraud, and manage risks effectively.

Why cloud native observability for FinTech?

In the fast-paced world of FinTech, observability can be the key to driving innovation further and faster, while enhancing the productivity of engineers and delivering exceptional experiences for customers.

However not all observability platforms are created equal. Traditional application performance monitoring tools or the Do-it-Yourself (DIY) open source software (OSS) route can present their own set of challenges. They can be expensive and complex to manage, particularly at scale. They may also lack the necessary features or flexibility to monitor the diverse and dynamic microservices architectures that FinTechs employ.

Cloud native observability offers real-time insights into system performance and reliability. This capability is especially vital for FinTechs due to their reliance on real-time transactions, customer-facing applications, and the complex microservices architectures they often employ.

For example, a digital payment platform must be able to monitor transaction times, detect fraudulent activity, and ensure data security at all times. A mobile banking application can benefit from cloud native observability by proactively identifying system bottlenecks or failures that could impact the user experience. Similarly, in automated investing or advising, observability can detect anomalies and prevent potential losses.

With cloud native observability, teams can track these parameters in real-time, enabling the quick identification and resolution of any issues, thus maintaining a seamless customer experience.

With the right cloud native observability solution, FinTech companies can unlock the true potential of their technology stack, drive innovation, and maintain a competitive advantage while navigating the challenges of an evolving market.

Chronosphere’s benefits to FinTechs

Leading disruptors in financial services industry such as Robinhood and Affirm have placed their trust in Chronosphere’s cloud native observability for its ability to deliver significant benefits in cost-efficiency, customer experience, and engineering productivity:

- Control costs: With Chronosphere FinTechs only pays for the data they choose to retain. This cost-effective approach allows them to optimize their expenses, particularly as data volumes grow over time. Because Chronosphere transforms observability data based on need, context, and utility, they can fulfill their existing monitoring needs without having to store all the data in the raw form, saving on expensive storage and hardware.

- Exceed customers’ expectation: The Chronosphere platform is designed to help FinTechs deliver a world-class customer experience by providing efficient data collection and storage capabilities at scale. With a market-leading SLA of better than 99.9%, and by proactively monitoring and detecting potential issues before they impact users, Chronosphere enables FinTechs to provide a seamless customer experience. With context-rich alerts and seamless linking of data types, engineers can triage and resolve issues quickly. This results in faster time to resolution and improved customer satisfaction.

- Improve developer productivity: By empowering developers with the tools and data they need to work more efficiently and effectively, Chronosphere accelerates innovation and improves time to market. Specifically, the advanced observability capabilities in Chronosphere give developers deep insights into system performance and potential issues so they can rapidly identify and remediate issues before they impact customers. The scalable nature of the platform can easily accommodate growing infrastructure needs while cutting complexity and keeping FinTechs ahead of the competition. With insights into consumption and trends, the optimization of observability data, and the identification and removal of unused dimensions and unimportant distinctions — Chronosphere drives greater performance and efficiency.

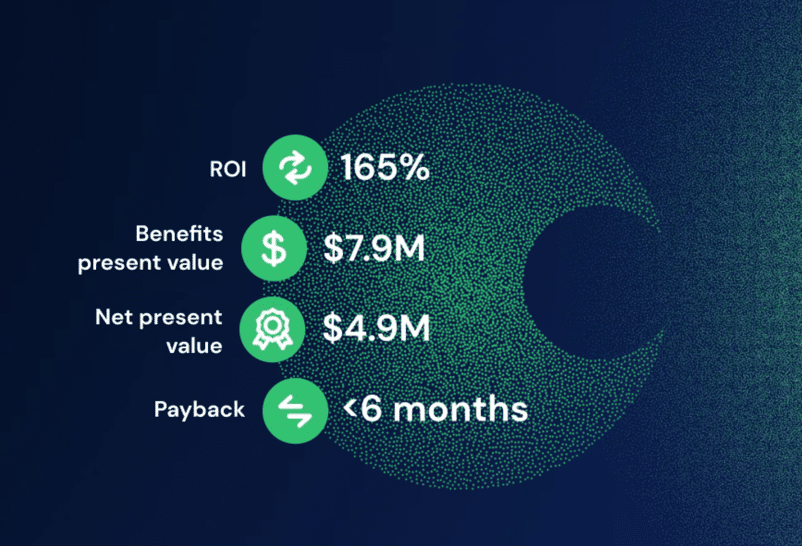

The quantifiable benefits of Chronosphere are also significant and published in the Forrester Total Economic Impact™ of Chronospherereport. They include a 75% annual reduction in incidents, leading to over $5.2 million in savings over three years, and mitigating revenue loss during customer-facing events.

Cloud native observability is no longer a nice-to-have for FinTechs – it’s a must. By harnessing the power of Chronosphere’s cloud native observability platform, FinTechs can achieve effective cost control, exceed customers’ expectations, and enhance developer productivity. These benefits not only drive operational efficiency but also position FinTechs for continued success in the competitive landscape of the financial services industry.

Download the Financial Services buyer’s guide for details about how Chronosphere can support your FinTech’s cloud native journey.